Table Of Content

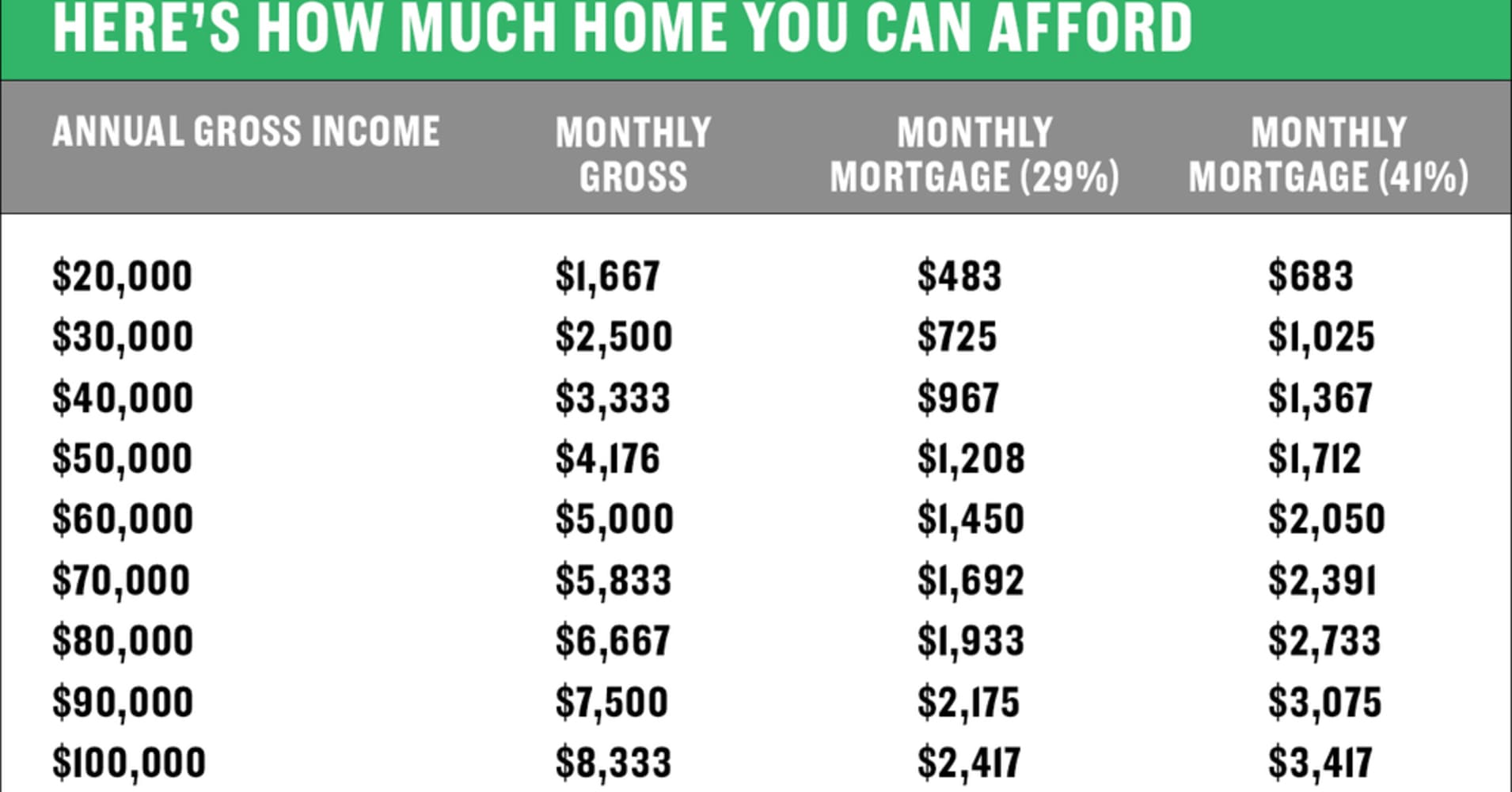

First-time home buyers often get excited when starting the loan process. Once approved, they might be tempted to start shopping and putting in offers on houses immediately, but that might create an issue if they have a high interest rate. To better estimate your monthly mortgage payment amount, use the Rocket Mortgage® mortgage calculator.

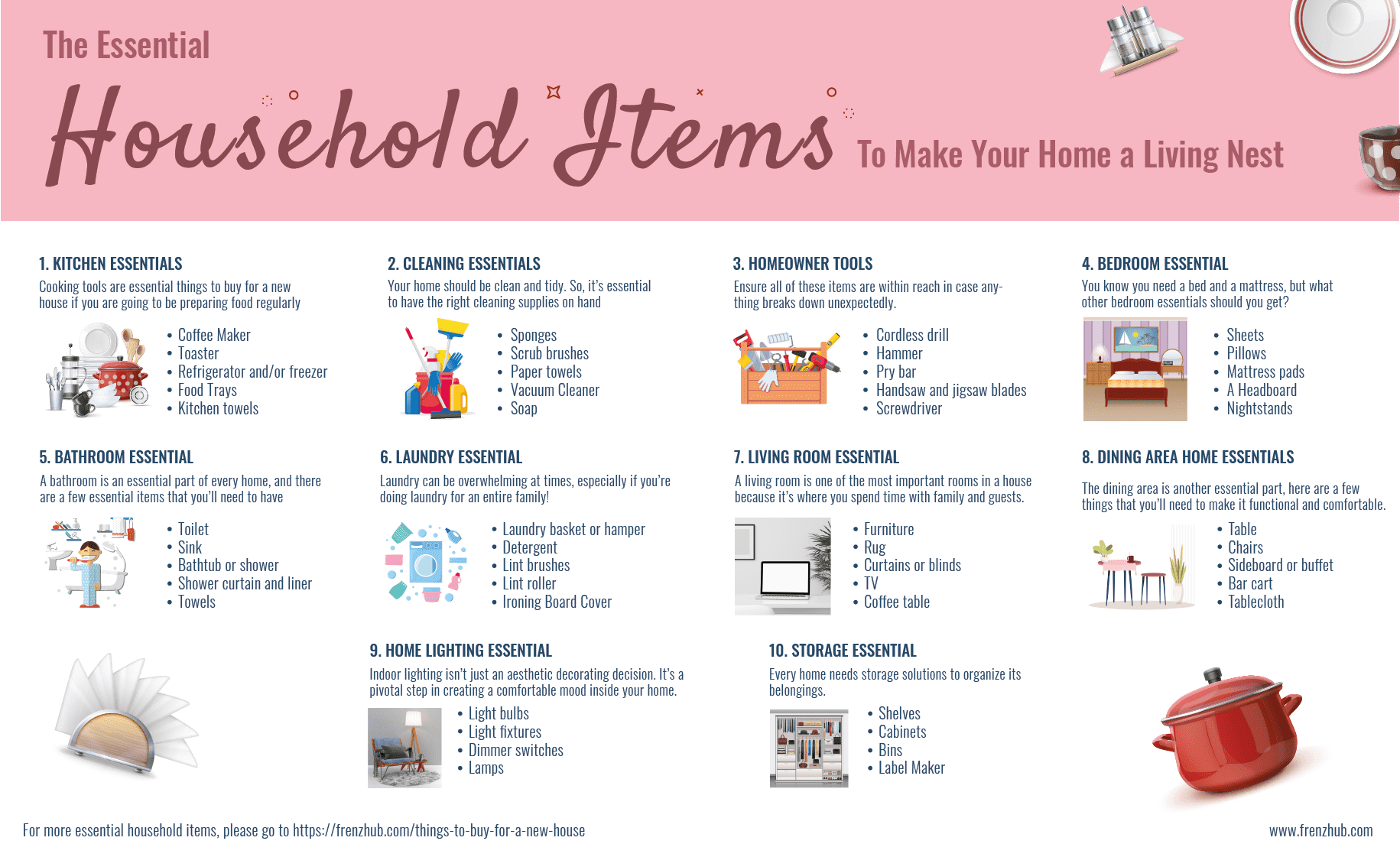

Help me budget

If you're doing it yourself, your out-of-pocket costs will be lower (though your back might not be happy!). But you’ll still have to budget for packing materials, such as boxes and tape. If you're thinking about becoming a homeowner, here's a rundown of the costs of buying a house. These ranges are broad because you have so many options for financing a house and people have varying financial circumstances. To personalize your estimate, you need to learn what your options are.

When There’s No Money Down

Do you have enough savings that a down payment won’t drain your bank account to zero? If your personal finances are in excellent condition, a lender will likely be able to give you the best deal possible on your interest rate. As a home buyer, you’ll want to have a certain level of comfort in understanding your monthly mortgage payments.

What income do I need to afford a $400K house?

It can take weeks or even months before your purchase closes, and you don’t want anything to change your finances until the deal is completely done. For example, don’t apply for new credit cards or make purchases that require financing, like a car, because those can affect your credit score. And if possible, don’t switch jobs or make any big life changes, such as getting married, either. "[E]levated mortgage rates and high home prices have been keeping some buyers on the sidelines this spring," Bright MLS Chief Economist Lisa Sturtevant said in an email.

And if applying for Fannie Mae‘s HomeReady or Freddie Mac‘s Home Possible, your income must not exceed the limit set for your area. According to a Consumer Financial Protection Bureau study, more than three-quarters of all borrowers only applied for a mortgage with one lender. Failing to comparison-shop could cost you thousands over the life of the loan. We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

How does the type of home loan impact affordability?

Some appraisals include inspections, like for FHA loans, but the FHA also encourages buyers to get a separate home inspection. When negotiating with the seller, ask them which appliances come with the house and which ones they plan to take with them. You may score a great deal on large appliances by offering to buy them from the seller.

In fact, many people do put down less than 20% when buying a home. The median down payment for all US homebuyers in 2023 was 14% of the purchase price, according to The National Association of Realtors. The average down payment varies a great deal depending on the age of the buyer, as well. A down payment is the portion of the home purchase the buyer makes in cash upfront, with the rest of the purchase covered by the mortgage. For conventional and FHA loans, a down payment is required to buy a home. These funds can come from your savings, a gift from family or a friend, proceeds from the sale of another home, grants and other sources.

How To Improve Your Credit Score to Buy a House

A down payment will lower the amount you borrow which, in turn, can lower your monthly payments. For example, if you make a 20 percent down payment on a $400,000 loan, you’re borrowing only $320,000. That will result in lower payments spread over 30 years than if you were paying off a larger loan over the same period. Other factors, such as your repayment terms and interest rate, also affect your monthly mortgage payments. Home buyers using either loan program get access to discounted mortgage rates and reduced mortgage insurance premiums.

You’ll need to determine a budget that allows you to pay for essentials like food and transportation, wants like entertainment and dining out, and savings goals like retirement. These premiums protect the mortgage lender in the event you default on the loan. PMI payments are generally included in your monthly mortgage payment. Once you have at least 20% home equity, mortgage insurance can be canceled. Two major government-backed programs offer zero-down payment mortgages, although the individual lender will have certain credit score requirements that you’ll need to meet. VA loan lenders typically require a minimum score anywhere between 580 and 620.

The biggest impact of rising interest rates has been in southern England where house prices are higher. Annual mortgage repayments have increased by up to 70% since 2021, according to new data from Zoopla. The rising cost of homeownership means sellers and buyers should enter today's market with lowered expectations, said Redfin economic research lead Chen Zhao. Americans are expected to buy 4.46 million existing homes this year, a 9% increase from 2023. Even so, many would-be buyers have been priced out of the market, economists say.

A 650 credit score makes you eligible for most types of home loans, including conventional, FHA, VA and USDA loans. Still, this score falls within the top of the fair credit score range, which means you’ll likely qualify for higher interest rates, resulting in a pricier monthly payment. Another big benefit for first-time home buyers is that VA loans don’t require ongoing mortgage insurance. Unlike FHA and USDA loans, which both charge mortgage insurance premiums every month, the VA loan has one upfront “funding fee". As a first-time home buyer, you can choose how much money you want to put down towards the home’s purchase price. The down payment can be as large as you wish, or as small — so long as you make the minimum investment required by your mortgage lender and loan program.

You’ll need to also consider how the VA funding fee will add to the cost of your loan. Most financial advisors agree that people should spend no more than 28 percent of their gross monthly income on housing expenses, and no more than 36 percent on total debt. The 28/36 percent rule is a tried-and-true home affordability rule of thumb that establishes a baseline for what you can afford to pay every month. That means your mortgage payment should be a maximum of $1,120 (28 percent of $4,000), and your other debts should add up to no more than $1,440 each month (36 percent of $4,000).

Mortgage Calculator: Estimate Your Monthly Payments - Business Insider

Mortgage Calculator: Estimate Your Monthly Payments.

Posted: Mon, 01 Apr 2024 07:00:00 GMT [source]

Many consider an excellent credit score to range between 740 and 850. There are several places to check your credit score for free or a small premium. It will be your FICO Score or VantageScore, depending on the service. Instead, the VantageScore 3.0 model is most often used by credit monitoring services. The scoring range is from 300 to 850 and is based on six credit factors instead of five like your FICO Score. The overwhelming majority of lenders use the FICO credit scoring system developed by Fair Isaac Corporation.

$900 to $2,500 for most local moves; higher for longer distance, more stuff or additional services. Relocating is a cost, too, whether it's across the country or across town. Professional movers cost more than a DIY move, but you might find the convenience to be worth the price.

Its scoring range is from 300 to 850 and is based upon five credit factors. You may be able to get into a home sooner and for less money with down payment assistance from a first-time homebuyer program. Figuring out the appropriate size of a down payment on a house is a common challenge for home buyers. We’ve got answers to a few frequently asked questions to help you make the right decision.